Child support is typically paid directly from one parent to the other by way of a personal check, or direct bill pay from one account to the other. When there is doubt that the child support will be paid monthly, then a wage assignment will be put in place (also known as a wage garnishment). As you will often see in parenting plans or Marital Settlement Agreements, there is a paragraph alerting the payee parent (the parent who receives the support) that they have a right to request a wage assignment at any time. Even if the payee didn’t request one upfront. It will always be an option if the payor (the paying parent) fails to make their child support payment.

How Child Support is Paid

A child is entitled to be supported in a style and condition commensurate with the position in life and standard of living enjoyed by both parents. In determining a parent’s ability to pay child support, a court may consider the value of that parent’s share of the community property, as well as any separate property the parent may have. The amount of child support to be paid by each parent is based on the amount of time each parent spends with the child and their net income. Income is defined as money from all sources including self-employment, job wages, savings accounts, unemployment money, disability and worker’s compensation, and Social Security. The judge may consider the amount of money the parent could be making, instead of the parent’s actual income, if that parent is underemployed. This is called “imputing income.”

Net income is calculated by taking a person’s total gross income and subtracting certain expenses, such as federal and state income taxes, health insurance premiums, state disability insurance, and Social Security taxes. The judge may also consider other expenses, including the cost of raising a child from another relationship, exceptional health care expenses, uninsured catastrophic losses, mandatory union dues, or retirement contributions. Once each parent’s net income is calculated, the child support guideline is used to determine the percentage of net income to be paid as child support.

The final amount of child support is carefully determined by a judge based on individual case information if you are litigating your parenting plan. If you are mediating your divorce (or child support issue), you and your co-parent will be the final decision-makers as to what the final amount will be. However, keep in mind, that child support is not “waivable,” as spousal support may be. Child support is a right that belongs to the children themselves and not to the parents, therefore the parents cannot waive their right to request support if they need it to support their children.

Calculating Child Support

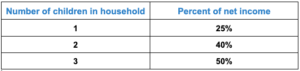

The example below is a general guideline for calculating child support.

The formula also considers how much time each parent spends with the child(ren). For example, the custodial parent and noncustodial parent have 1 child. The noncustodial parent’s net income is $2,000 per month resulting in a child support share of $500 per month. (25% of 2,000). If the custodial parent’s net income is $1,500 per month, the child support share is $375 per month (25% of 1,500). These percentages are adjusted according to the amount of time each parent spends with the child.

Components of Child Support

Child support covers only ordinary living expenses for a child. It does not include childcare, medical bills not paid by insurance, travel expenses for visitation with the noncustodial parent, or a child’s special education needs. Parents must specifically ask to include these additional expenses in the child support order. If they do not, the costs may be divided so each parent pays 50 percent. It often makes sense to keep these costs out of child support and pay them 50%/50% each, as they can change over time, and it would require a child support modification when the expenses change. In our experience, parents like to minimize the changes they have to make yearly. The law requires one or both parents to provide health insurance coverage for their child(ren), including vision and dental care coverage, if it is available through a job or group insurance plan at no or reasonable cost to the parent.

The above guidelines are a simplified version of how the court calculates support. However, different circumstances in each case tailor the amounts of child support ordered by the court. For specific information about the child support guidelines and formula, see the Statewide Uniform Guidelines for Determining Child Support listed in the California Family Code Sections 4050-4076.

When you go through mediation with us, we will accurately calculate child support and help you and your co-parent establish how other expenses will be paid. We will strive to predict possible future expenses and put guidelines in place so you and your co-parent will have a plan to resolve issues or conflicts as they arise.

by: Jennifer Segura